Irrespective of trade deals, Brexit will leave UK households worse off

A new report has revealled that Britain’s withdrawal will cost ordinary Britons dearly, even if the nation uses the opportunity to replace its pre-existing trading relationships with the continent to new deals elsewhere. If Brexit sees the UK strike free trade deals with non-EU countries, it will still cost households an additional average of £134–758 every year, with that rising by 20-45% without the deals, at £245–961.

A study from consulting firm Oliver Wyman has added to the volume of voices warning that the UK faces economic turmoil on the back of Brexit. Earlier in 2018, a leaked Civil Service analysis disclosed to the British press that growth over the coming 15 years could be as much as 8% lower than if the UK remained in the EU, as talks between the UK Government and Brussels remained deadlocked over issues including a hard border in Ireland, and the fate of millions of EU and UK expats left on either side of Brexit.

Oliver Wyman had previously suggested that a No Deal scenario could see households stung to the tune of £1,000 because of the new regulations incurred by a Hard Brexit, however global free trade deals were subsequently cited by many defenders of Brexit as a possible solution to the rising costs expected to affect consumer businesses, their supply chains, and consumers after the UK leaves the EU. Now, Oliver Wyman’s report, which is its most comprehensive research to date, highlights that the red-tape costs from any new arrangement with the EU Customs Union will outweigh the benefits gained from negotiating free trade deals covering imports from non-EU countries.

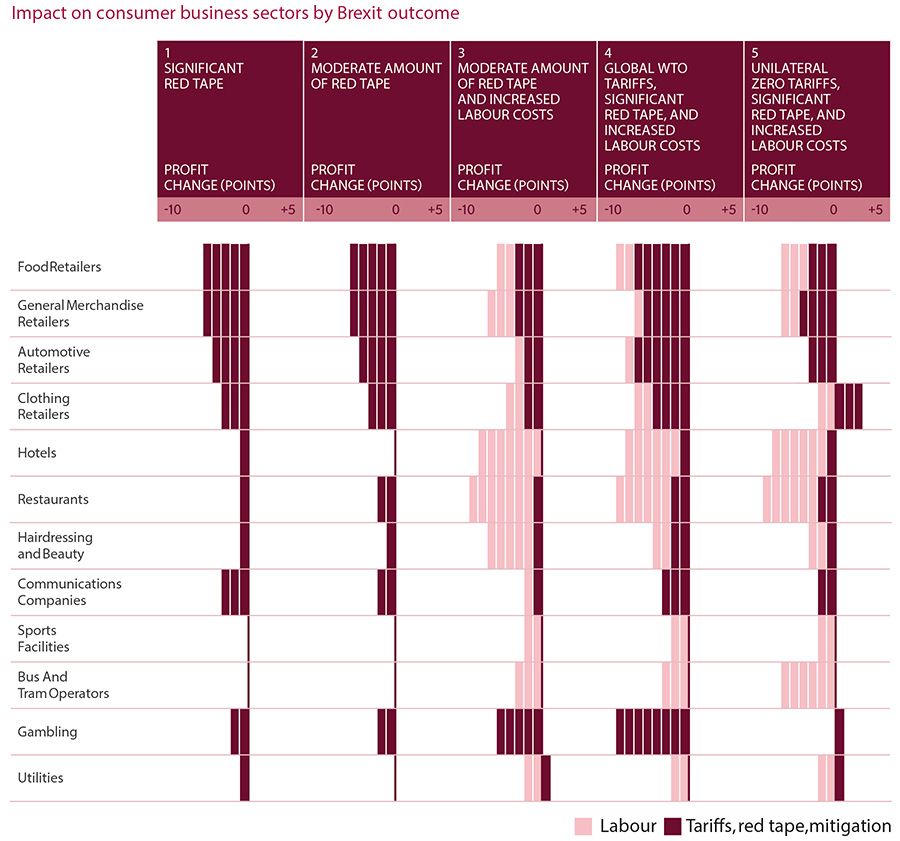

According to the study, for consumer businesses, the benefits of global free trade agreements in place of EU-membership would be negligible. Brexit would likely see a profit fall of between 1.1 and 4.2 points. Free trade deals would only lessen that impact by 15-35%, while and businesses’ profit margins would still be impacted negatively by between 0.7 and 3.4 points. This is because, whichever trade deals might be agreed, the fact that the UK is leaving the EU will create new red tape costs for imports coming into the UK from the Customs Union.

Duncan Brewer, an Oliver Wyman Partner and lead author of the report, said, “No matter which trade deals are agreed, the fact that the UK is leaving the EU will create new red tape costs for imports coming into the UK from the Customs Union. Our research clearly shows that costs from this red tape are always higher than any cost reductions gained from free trade deals, leaving businesses and households worse off after Brexit.”

The analysis shows that supermarkets are likely to be among the worst hit by Brexit red tape, illustrating how rising costs are likely to hit the mass of the British public. A typical UK supermarket with revenues of £10 billion is forecast to lose between £214.8 million and £737.1 million in profit, unless it raises prices. Even in a scenario with more moderate tariffs, the difficulty for food retailers to source adequate labour following Britain’s severance from the EU will see increased labour costs also hit consumer’s pockets, pushing prices up by 2.3-7.8%. Elsewhere, a typical general merchandise retailer with revenues of £1.5 billion could expect to lose between £30.5 million and £83.9 million in profit, unless it raises prices, leading to a likely increase between 3.0-8.0%. A typical UK restaurant chain with revenues of £100 million could expect to see a drop in profit of between £600,000 and £4.8 million, leading to a likely increase in pricing of 0.7-6.6%.

Perhaps unsurprisingly, lower-income households would be hit the hardest by rises in food prices. According to the researchers, after rent and housing costs, this group typically spends a larger portion of its income on groceries. Lower-income households typically see 17% of their pay spent on the necessities of life, compared to 9.4% of Britain’s highest earners. In the Hard Brexit scenario analysts modelled, those on the lowest income will also see their overall costs increase by 3% more than those earning the most.

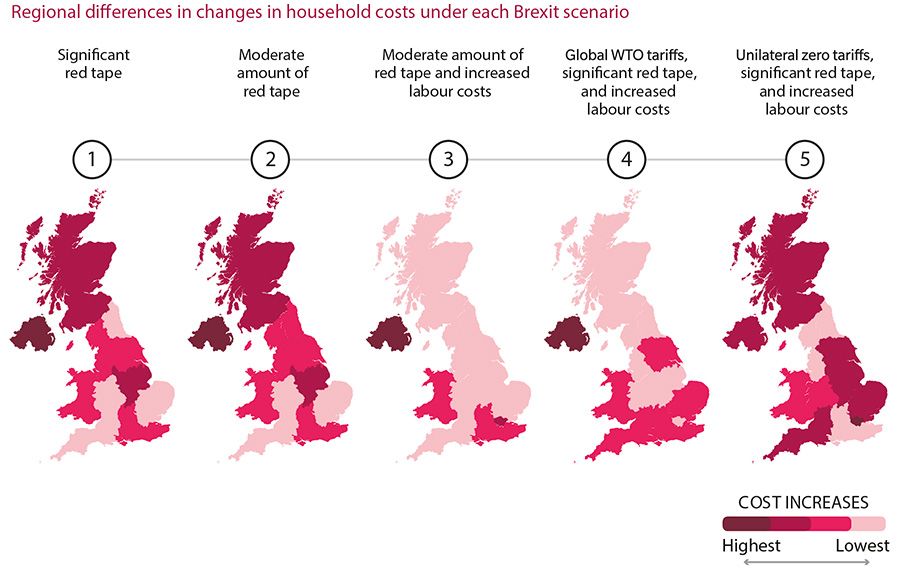

There are also significant geographical disparities in terms of who would be hit hardest by price rises. In any scenario in which the amount of red tape pertaining to trade changes, or the ease of access to labour shifts, Northern Ireland will see some of the highest price increases in the country. Similarly, in any scenario devised by Oliver Wyman, Wales will experience at least moderate price hikes. In the moderate amount of red tape and increased labour costs scenarios, these two were part of only four regions to see a significant rise in cost, the other two being the South East and London. On the other hand, East Anglia and London are likely to only see notable price changes in two scenarios each.